b c d e f g h i j k l m n o p q r s t u v w y z search |

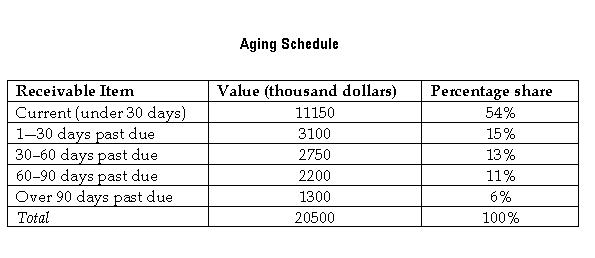

TeachMeFinance.com Aging Schedule -- Organization of business Accounts Receivable according to sale period. As a rule, the schedule is made by a company auditor and is a crucial instrument for assessing the worth of the firmfs investment in receivables. Creditors often need to consult the aging schedule before lending money to a company.

An aging schedule may be either an inventory of receivables that are categorized under current and delinquent, or it may be a record of receivables contracted in a specific month.

The aging schedule helps in identifying those areas of deliquescence where attempts to recover need to be focused. It also helps in understanding the sufficiency of the reserve for Bad Debts since the greater the period of lapse beyond the date of payment, the more the likelihood of no payment. As customers who have defaulted over a long period usually move to fresh suppliers, their demarcation in an ageing schedule serves as a guide for future sales strategy.

About the author

Copyright © 2007 by Mark McCracken, All Rights Reserved. |